- The Wolf on Wealth

- Posts

- Netflix vs. Paramount

Netflix vs. Paramount

Ellison made six bids over 12 weeks. Most sellers quit after one "no." He kept refining, repricing, restructuring. Each rejection revealed what Warner actually wanted.

👋 Good Morning. Six rejected bids in 12 weeks. Most sellers quit after one no. David Ellison just launched a $77.9 billion hostile takeover instead—and redefined what persistence looks like.

Read time: 3 minutes | 710 words

STORY

The $77.9 Billion Showdown for Warner Bros.

David Ellison isn't taking no for an answer.

The Paramount CEO launched a stunning hostile takeover bid Monday. His target? Warner Bros. Discovery—at $77.9 billion, all cash.

The timing couldn't be more dramatic. Just days earlier, Warner agreed to a $72 billion deal with Netflix.

The Relentless Pursuit

Ellison has been chasing Warner for months. Six formal proposals. Multiple dinners with Warner CEO David Zaslav. Each bid higher than the last.

The progression tells the story:

September: $19/share (cash and stock)

Late September: $22/share

October: $23.50/share

November: $25.50/share

Early December: $26.50/share

Final bid: $30/share—all cash

Zaslav eventually ghosted him. "Just tried calling you about new bid we have submitted," Ellison texted on December 4th. No response came.

By Friday, Warner announced the Netflix deal instead.

What's at Stake

This isn't just about billions—it's about Hollywood's future. Warner owns the studios behind Casablanca, Game of Thrones, and The White Lotus.

The package includes:

HBO and HBO Max streaming

DC Comics (Batman, Superman)

Warner Bros. studios

Major gaming assets

CNN, TBS, HGTV networks

Netflix currently dominates streaming with 302 million subscribers. Warner has just 128 million. Combined, they'd reshape the entertainment landscape entirely.

The Power Players

Ellison isn't fighting alone. His father Larry—Oracle's billionaire co-founder and Trump ally—mobilized immediately after Netflix's announcement.

Paramount's backing includes:

Bank of America, Citi, and Apollo ($54B in debt)

Saudi Arabia, Abu Dhabi, and Qatar sovereign wealth funds

Jared Kushner's private equity firm

Trump's influence looms large. David Ellison reportedly promised sweeping CNN changes in recent Washington meetings. Larry called Trump after the Netflix deal, warning about competition concerns.

The Showdown

Paramount argues its offer delivers $18 billion more cash. They're taking the case directly to shareholders, who have until January 8th to decide.

Warner's board still recommends the Netflix deal. Netflix included a record $5.8 billion breakup fee—signaling supreme confidence in regulatory approval.

If Warner walks to Paramount, they owe Netflix $2.8 billion.

What Happens Next

Hostile takeover bids are expensive, time-consuming, and often fail. It's audacious for $15 billion Paramount to challenge $400 billion Netflix.

But with Trump involvement, regulatory uncertainty, and shareholder pressure, this battle is far from over.

One certainty: Hollywood's future hangs in the balance.

TOGETHER WITH NIBBLES

Protect your pet. Get rewarded.

Vet bills aren’t getting any cheaper. Costs have jumped more than 60% in the last decade, and pet owners are feeling it. But one new card is actually helping lighten the load.

The Nibbles Pet Rewards Credit Card offers 3x rewards on pet purchases - from vet visits to toys - and even includes free pet insurance for one eligible pet, with no annual fee. It’s a smart way to save while keeping your best friend happy and healthy.

INSIGHT + ACTION

💼 Sales Lessons from Paramount's $77.9 Billion Battle

1. The Fortune is in the Follow-Up (Literally)

Ellison made six bids over 12 weeks. Most sellers quit after one "no." He kept refining, repricing, restructuring. Each rejection revealed what Warner actually wanted.

Action: Map out 6-8 touch points before calling a deal dead. Each "no" is intelligence gathering. Ask: "What would make this a yes?"

2. Listen for the Real Objection

Paramount offered cash-and-stock combos for months. Warner kept saying no. Finally, Allen & Co. spelled it out: "Cash is king." The sixth bid? All cash at $30/share.

Action: Stop pitching harder. Start asking better questions. "If we could only change one thing about this proposal, what would move the needle?" Then actually change it.

3. When Gatekeepers Block You, Go Around Them

Zaslav ghosted Ellison's texts and calls. So Paramount took the offer directly to shareholders. Hostile? Yes. Necessary? Absolutely.

Action: Identify who actually signs the checks versus who controls access. Build parallel relationships. If the VP stonewalls you, can you reach the board? The end users? The shareholders?

4. Bring Proof of Resources, Not Just Promises

Paramount didn't just say "we'll pay $77.9 billion." They showed up with Bank of America, Citi, Apollo, and three sovereign wealth funds locked in.

Action: Kill deal skepticism before it starts. Bank commitment letters beat "we can probably get financing." Signed partnership agreements beat "we're talking to suppliers."

5. Timing Beats Perfection

Netflix's bid was lower ($27.75 vs. $30/share) but came with speed certainty. Warner wanted to move fast. Paramount's multiple revisions signaled indecision.

Action: Sometimes shipping a B+ proposal today beats the A+ version next month. Signal decisiveness. Have your financing, team, and timeline locked before the pitch meeting.

TOGETHER WITH BLUEALPHA

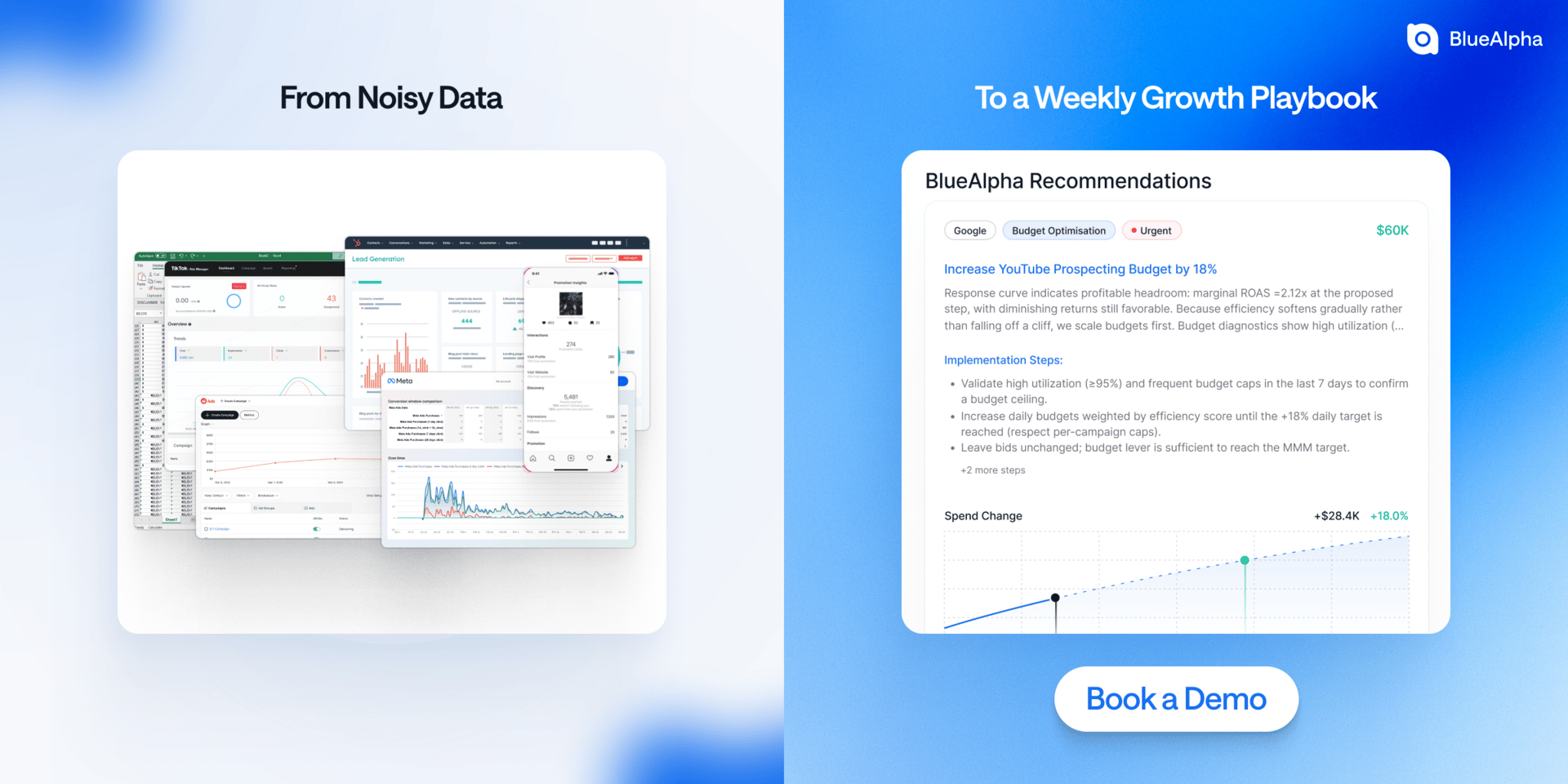

Make Every Ad Dollar Work Harder

Great measurement is pointless if you don’t act on it.

BlueAlpha is the AI Action System for Marketing, built to turn noisy data into weekly, campaign-level moves your team can actually take. Not dashboards. Not stale reports. Actions.

Every week, BlueAlpha delivers transparent, trusted recommendations your team can approve in minutes. Reallocate. Scale. Cap. Pause. All backed by Bayesian MMMs, causal tests, and explainable AI from the team that built Tesla’s growth systems.

Brands like beehiiv, MUBI, and Klover, use BlueAlpha to cut waste, compound ROI, and grow faster.